Post office fixed deposits have always been a favorite investment for Indians; security of returns is guaranteed. With the Post Office FD Calculator 2025, saving has become much simpler and smarter. It lets an investor calculate how much will be received on maturity, depending upon the principal, interest rate, and tenure, thus enabling him to make an informed decision on his finances.

How Does Post Office FD Calculator Work?

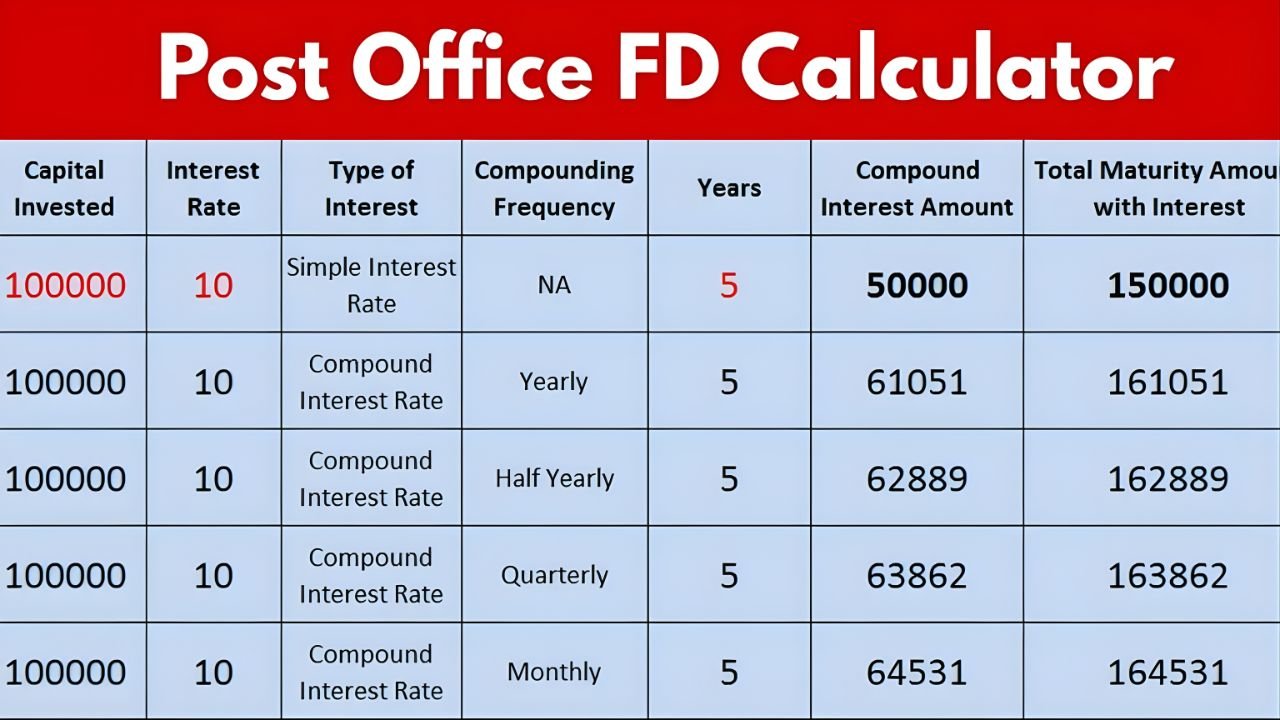

The Post Office FD Calculator calculates interest accrued through a simple formula. You have to set the deposit amount, choose tenure either in years or months, and set the interest rate applicable. These values will give you the breakdown of the total interest accrued and the maturity value, so you have clear knowledge of your potential returns. With manual calculation taking a lot of time and chance for errors, the FD calculator saves time and makes financial planning easy.

Benefits of Using the FD Calculator

The calculator allows you to compare various deposit schemes offered by the post office, such as the regular Fixed Deposit, Monthly Income Scheme, and Senior Citizen Savings Scheme. You can try out different interest rates and tenures to see which one fits best with your financial goals. The calculator also shows you how compounding works; this enables your money to grow properly with time.

Investment Planning for 2025

In 2025, interest rates will not remain the same; should they fluctuate, one must avail of the use of a Post Office FD Calculator so that insufficient utilization of the money does not occur. An investor can have a short-term investment if liquidity needs demand it, or a long-term one. A senior citizen will appreciate even slightly varying rate returns more than significantly impacting those practically, hence it is highly relevant for senior citizens that such calculations be made precisely. The tool is also helpful in budgeting, as it allows an investor to make tax-efficient investments by estimating returns after tax deductions.

Conclusion

The Post Office FD Calculator 2025 strengthens one’s effort to secure money and plan for the future. It helps provide an instant view of how much money one can earn in interest and how much money will be earned on maturity, thus empowering investors in making an educated decision. From saving for short-term investments to long-term financial security, this calculator simplifies investment planning, making the whole process smarter and more accurate.